Choosing the wrong business structure can cost your company thousands of dollars per year in unnecessary tax payments. This article will cover the options available to Wisconsin business owners.

Blog

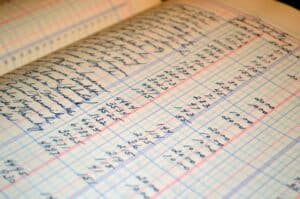

The Real Cost of DIY Bookkeeping: When Milwaukee Area Businesses Should Call a Professional

DIY bookkeeping might save money in the short term, but it typically costs more in the long run as you devote more of your time managing the books instead of growing your business.

Real Estate Tax Strategy: 1031 Exchanges

There are several advantages to using a 1031 exchange when investors want to build their real estate portfolio, but it’s not the right fit for everyone. The tax deferral benefits are substantial for investors with significant gains, but the timing requirements and reinvestment obligations require careful planning.

Section 179 in 2025: New Changes That Could Benefit Your Business

Section 179 is a provision of the IRS tax code that allows businesses to deduct the full purchase price of qualifying equipment in the year it’s purchased and put into service.

7 Smart Moves for Small Business Owners to Minimize Tax Liabilities

Don’t wait until next year to contact us about this year’s taxes. The time-sensitive suggestions in this article are critical milestones for your business’s profitability and minimizing tax liabilities.

Tax Deductibility of Employer Contributions: Retirement and Healthcare Plans

Understanding the tax benefits of employer contributions to employee healthcare and retirement plans is essential for any business.